Yellow Card raises $33 million for growth, expansion

On Thursday, October 17, Yellow Card announced that it has raised $33 million in a Series C funding round to support its growth and expansion efforts.

The funding round was led by Blockchain Capital, with contributions from Polychain Capital, Third Prime Ventures, Castle Island Ventures, Block, Inc., Galaxy Ventures, Blockchain Coinvestors, Hutt Capital, and Winklevoss Capital. With this latest funding, Yellow Card’s total investment has reached $88 million, following a $15 million Series A in 2021 and a $40 million Series B in 2023.

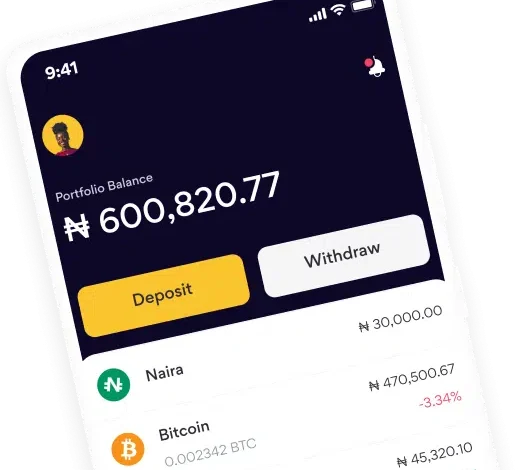

The fintech company plans to use the new funds to enhance its operations, particularly by improving its API and widget products. These tools help international businesses, including Coinbase and Block, enter African markets and allow Pan-African companies to make international payments easily while managing their finances with stablecoins.

Yellow Card is also focused on developing new and innovative products for the continent, strengthening its team and systems, and engaging with regulators across Africa.

In January 2024, Yellow Card partnered with Coinbase, a cryptocurrency exchange in the U.S., to offer access to USDC and digital assets in 20 African countries. This partnership enables Coinbase wallet users in Africa to make payments in their local currency using local bank transfers and mobile money, providing a smoother customer experience and simplified KYC processes.

Founded in Nigeria in 2019, Yellow Card operates in 20 countries and facilitates over $3 billion in transactions across Africa. It claims to be the largest and first licensed Stablecoin on-ramp/off-ramp on the continent, offering secure and cost-effective methods for businesses to buy and sell USDT, USDC, and PYUSD using local currencies through its Payments API.

In 2022, Yellow Card became the first cryptocurrency company in Africa to receive a Virtual Asset Service Provider license in Botswana. In 2023, it partnered with Block, the company behind Cash App and Square, to facilitate cross-border payments between 16 African countries, including Nigeria, Ghana, and South Africa.

As Yellow Card looks to grow with this new funding, it faces challenges similar to other startups in the space. For instance, Paxful, a U.S.-based crypto exchange with a significant presence in Africa, has shut down operations, and Mara has rebranded to Jara due to financial difficulties.

This funding announcement comes at a time when several African countries, including South Africa and Nigeria, are taking steps to regulate the cryptocurrency sector.