MTN Group, the South African mobile telecom giant, has reported a significant loss for the first time since 2016.

The company announced a loss of R7.39 billion ($414.7 million) for the six months ending in June 2024, a sharp decline from the R4.14 billion ($232.3 million) profit during the same period last year.

This loss is mainly due to the drastic devaluation of the Nigerian naira, which has hurt the company’s earnings from its key market.

Since May 2023, the naira has fallen over 70% against the US dollar after President Bola Tinubu introduced foreign-exchange reforms and other economic policies to stabilize Nigeria’s economy.

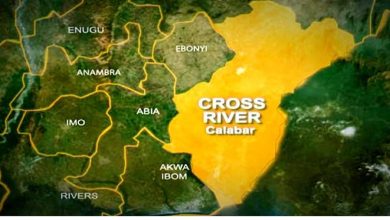

Nigeria, where MTN has about 77 million customers, has been a major revenue source for the telecom operator, contributing roughly one-third of its total earnings.

In addition to the currency issues in Nigeria, operational problems in Sudan due to ongoing conflict have also worsened the company’s financial troubles.

This loss is notable as it is the first time MTN has reported a negative result since 2016, the same year the Nigerian government fined the company more than $1.5 billion for regulatory issues, reduced from an initial fine of $5.2 billion.

Despite these challenges, MTN South Africa performed well, showing resilience in a tough economic climate.

For the same six-month period, MTN South Africa reported a 3.3% increase in service revenue, driven by strong growth in its fintech business and enterprise sales.

Ralph Mupita, MTN Group CEO, praised MTN South Africa’s performance, noting, “MTN South Africa, which completed its network resilience plan in the period, demonstrated encouraging progress in key areas of the business. This helped to drive some acceleration in overall service revenue.”

The company’s earnings before interest, tax, depreciation, and amortisation (EBITDA) increased by 3.8%, with the EBITDA margin rising to 36.6% — up 0.4 percentage points from the previous year.

MTN South Africa’s subscriber base grew by 4.7%, reaching 38.5 million by the end of June. Post-paid subscribers increased by 9.2% to 9.4 million, driven by the popularity of integrated voice and data plans and home broadband services. Prepaid subscribers also rose by 3.3% to 29 million.